Should ILS Funds Ever Have Non-Performing Assets?

Non-Performing ILS Assets

Non-performing assets within an ILS portfolio are typically to be found in the portfolios containing so-called illiquid ILS or more correctly collateralised transformed reinsurance. Cat bonds always pay a coupon, albeit for off-risk periods (e.g. pre-risk-inception, post-risk-expiry or if the bond is held in extension) such coupon may be low.

When collateralised reinsurance goes into extension typically no additional premium is payable during the extension period.

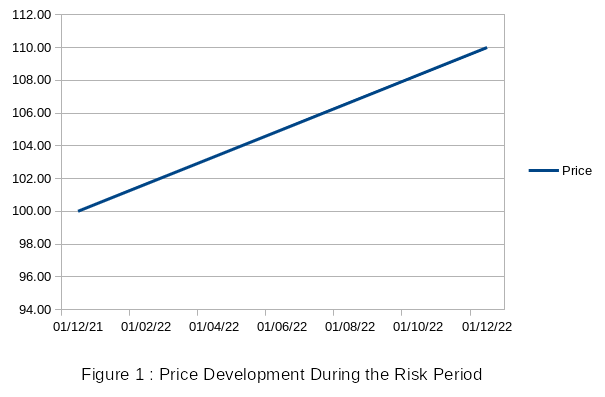

Assuming a fund has a 1-year 'zero-coupon' investment from a California earthquake reinsurance contract (earthquake risk amortises linearly over time) that pays 10% Rate on Line. Excluding any costs and risk-free return one would expect that the price of the investment to increase from 100 to 110 linearly over the year as shown in Figure 1.

The hope would then that no loss has occurred and the collateral can be released and redeployed.

However if a loss has occurred and it is know that this contract will have a total loss, no question about it, then the value will drop to zero. Again ignoring risk-free return, the bond is now a total loss.

The problem arises when the reinsured has a loss which is not yet large enough to be a loss to the contract but it large enough to keep the collateral outstanding.

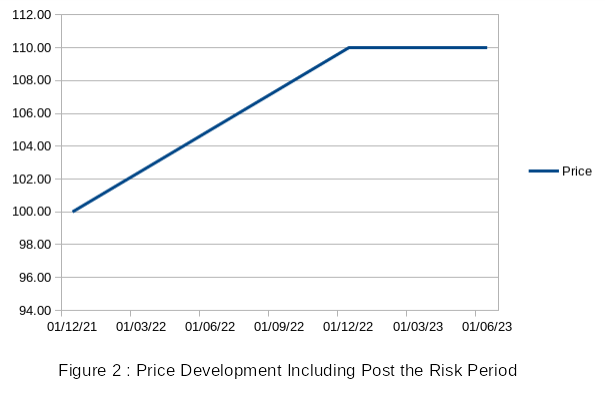

If the fund is convinced that the funds will come back in say 6 or 12 months then they might keep the valuation at 110 for the coming months. This would be shown in Figure 2.

We now have a non-performing asset, an asset that pays no coupon nor does it increase in capital value. The question is, "Should it really be valued at 110 for this extension period?".

Performance is a Function of Price

Typically funds will value positions on a form of a 'bid', maybe the 'best bid' or 'average bid'. There is clearly no bid on this position as it is illiquid and private. However would it be reasonable to assume that you could find a bid at 110 for this position?

The answer here is a clear and resounding "No!". No one would buy an asset for 110 which would redeem in 6-12 months at 110. Funds need to, at the very least cover their fees, fund running costs and some sort of return for their investors. The floor in the ILS space is typically an annual return of 2%.

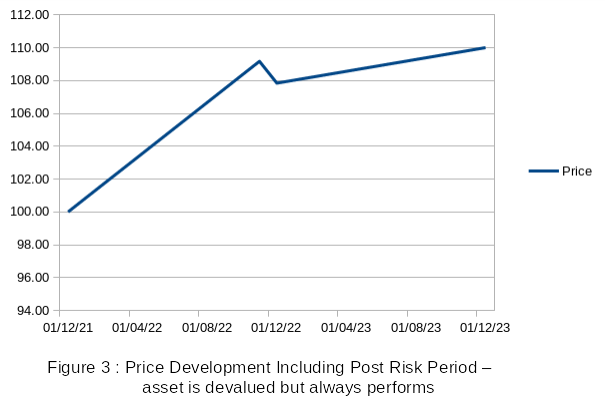

Therefore, if there really was no risk of the position not coming back at 110, only it would be somewhere between 6-12 months then one might assume at 31/12/23 a value of 107.84 and not 110. Given that the prior month the asset had been valued at 109.17 the new valuation at the year end of 107.84 is a drop in value. This can be seen in the price progression in Figure 3. This devaluation at the end of the year hurts the monthly result of the fund manager and he does not want to show it. He would rather hold the investment at a higher value and not earn off it for a period.

Is that a problem? If a new investor comes in at 01/01/23 then he is effectively buying into that asset at 110 when in reality it is only worth 107.84. He is overpaying to enter the fund. Conversely an investor leaving the fund at 01/01/23 is being redeemed for this investment at a value of 110 which is more than it should be worth. This punishes the investors entering or remaining in the fund and unfairly rewards those leaving.

Indeed in this example we have assumed that the investment will definitely redeem at 110, it is simply a matter of time. Reality is not so straight-forward. There would always be the possibility that the loss will increase in size during the next 12 months and cause a loss to the layer that this investment represents. This may mean a redemption at say 50 or even zero.

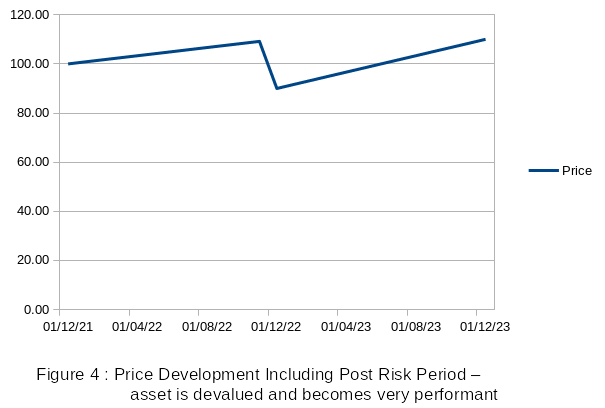

The price of 107.84 assumes that there is no risk of redemption less than 110 however, given that this risk does exist, the true value of the asset may be considerably less. Maybe only 90, or less still. At 90, as shown in Figure 4. after the write-down we have a very performant asset, one that even performs better than the original investment, albeit it may now have more risk associated with it.

If there is such an overvaluation (110 instead of 90) the impact on remaining fund investors when investors leave and on new investors joining is much more significant. It is further enhanced by the fact that if a fund has a single contract in extension it is likely that a significant catastrophe event has occurred and say 10-20% of the portfolio may be affected.

This effect has been seen with certain funds when late reporting of losses, in particular Irma, meant that new investors post Irma found themselves paying Irma losses and investors who redeemed after Irma made an excess return that they shouldn't have.

How to get True Valuations for Illiquid Positions

This valuation issue can easily be solved. It is possible to make these 'illiquid positions' into liquid tradable positions. They can then be priced in the market and indeed sold. Fund managers would likely rather this did not happen as, as soon as the position has a 'low bid' they must mark it down. For the investors though it allows for investors to leave and join the fund at the correct price, to receive cash instead of 'side-pocket' shares and finally to have a book where all of the assets are performing month on month. Also it improves the comparison of fund performance; investors would know that performance is actual and not based on hopeful valuations.

For the fund managers there are some silver linings to this cloud: Once the position is marked down the fund can either (i) ride the price back up and make a good return; or (ii) sell it for cash and invest in new un-encumbered transactions; or (iii) start a distressed fund to take these positions from their funds and potentially third-party funds.

Distressed funds have a distinct advantage insofar as they do not correlate with the existing ILS funds (deterioration on Ian is uncorrelated with the occurrence of a hurricane in 2023), and equally they do not correlate with the greater capital markets. In effect it becomes a second uncorrelated asset class for ILS funds to sell to their investors. It keeps the forward-looking ILS funds clean of run-off risk whereas investors in the distressed funds are well aware that they are taking the deterioration of Ian, Irma and others, so the 'investor issues' with late-reporting go away.

Clearly a loss-making distressed fund won't keep investors long. This will force the market to price for sufficient profit upfront.

How can Funds and Investors Deal with Side-Pockets

Some funds have created side-pockets in which to put their distressed non-performing illiquid ILS contracts. In doing so they have left the problem squarely with the end-investor and have effectively washed their hands of the problem - `out of sight out of mind'!

And yet there is value for the fund manager there. As a side-pocket the manager earns no fees so it is a waste of assets which could be performing and earning. By taking out the side-pocket investments and making them transferable securities with an open market price they can be sold from the side-pocket.

Further, as mentioned above, the fund manager could set up a distressed fund to take a share of these side-pocketed transactions at a discount for new fund investors.

It effectively becomes a win-win-win proposition:

- a win for the exiting investor owning the side-pocket shares as they get some cash and shrink the size of the side-pocket;

- a win for the fund as they get fees again (there is also a strong argument for charging a performance fee as the distressed risk is less fortuitous and more based on the analysis skills of the manager rather than an `Act of God'), and finally;

- a win for new investors who can enter a new asset class which is uncorrelated to both normal ILS and econometric risks.

How to Transform Illiquid Preference Share into Liquid Tradeable Securities

The Replexus platform can do this, however one must first understand what Replexus is.

What is Replexus?

Replexus is set up to be an independent market place in the same way that Lloyd's is. Funds and investors can set up to receive risk via the market place as syndicates do in Lloyd's whilst brokers and cedents can bring risk to be covered to the market place and its participants, again as Lloyd's. Unlike Lloyd's however, in this market place investors can trade the risk as one would expect for capital markets players, buying and selling risk and re-pricing it on a daily basis. It is this re-pricing, buying and selling that avoids having non-performing assets. Finally, again like Lloyd's, Replexus provides services into the market place. Lloyd's provides the central fund, LPSO, LCO and the LATF to name but a few. Replexus can, but does not necessarily have to, provide structuring, placing, legal, vehicles, listing, settlement, trusts and custodial services to name a few. Apart from a few exceptions, participants can decide what they want to do themselves and what they want to outsource to Replexus.

How can Replexus support re-pricing and sale of illiquid collateralised reinsurance transactions?

Typically collateralised reinsurance transactions are transformed by cell structures owned and managed by the fund manager. The cell vehicles write reinsurance and fund themselves with preference shares. Often multiple transactions are done with one vehicle for cost savings and therefore the preference shares may not always be 'single-transaction' specific. This would already make them difficult to price and sell, but also selling such shares to third parties is typically excluded by the insurance manager. The insurance manager managing the vehicles enters into a management agreement with the fund manager and owes them a duty of care. They do not want the shares to be sold as they would then assume liabilities outside the management agreement through the share (and therefore company) ownership. These liabilities cannot be controlled or limited. Finally no fund wants to invest in a vehicle under the ownership or control of a competitor. Full independence is required.

This is where Replexus comes in. It can novate each single reinsurance policy from the cell owned by the fund and managed by the insurance manager to a Replexus insurer and issuer.

The collateral follows the novated policy and the preference shares held by the fund or its side-pocket are exchanged for electronically tradeable securities. These securities can also be listed if required meaning that they can be held by UCITS funds too.

An open-market price can now be sought for price discovery and the securities can either be sold to other funds or transferred between the managers own funds (potentially a new distressed fund?) at open-market prices.

The process has changed non-performing illiquid ILS assets into performing liquid ILS assets with an open-market price.

Conclusion

ILS funds are very reminiscent of Lloyd's, they are a small group of underwriters writing for third party capital and typically receiving business from the broking community and not directly. The development of such a distressed market is another step in the Lloyd's direction; it would be the ILS market's answer to 'Reinsurance-to-close' (RITC), however given that an ILS fund accounts on a weekly/fortnightly/monthly basis (rather than Lloyd's 3-year acccounting) the ILS RITC must equally be more flexible with the ability taking transactions out on an individual basis at any moment in time. Creating a market around it, trading and having price-discovery further enhances the mechanisms.

The overall conclusion would therefore be that NO! ILS funds should never have non-performing assets and, through the use of capital markets 'technology', ILS funds can deal with extensions and in so doing improve their offering to both investors and cedents alike.

- Log in to post comments